Table of Content

- What is the maximum purchase price I can afford?

- Home Loan Interest Rate, EMI Calculator for Rs 30 Lakh

- In last summit of 2022, EU agrees to slap more sanctions on Russia, additional funds for Ukraine

- After SBI, Now HDFC Bank Hikes Interest Rate On Fixed Deposits. Check Revised Rates Here

- Looking for a home loan?

The interest rate was 10.8% when I took the loan and it will be good if I get an offer around 8%. Pre closure is there, but i am not sure about the charges and i am paying EMI of Rs.20280 with the tenure of 15 years. I have taken home loan directly through HDFC LTD .The rate of interest and the processing fee was very high .This loan got sanctioned on time but the service was not upto the mark. This loan is active and they haven't inform me about the interest rates since I was busy. By a cumulative 75 basis points to 5.75%, in three successive steps since February 2019 and prodded banks to pass on the benefits to end-customers, as they have lowered only 21 bps as of June 2019. With this, the new pricing of HDFC Bank’s one-year MCLR comes at 8.60%, the sources said, adding the new pricing is applicable from August 7.

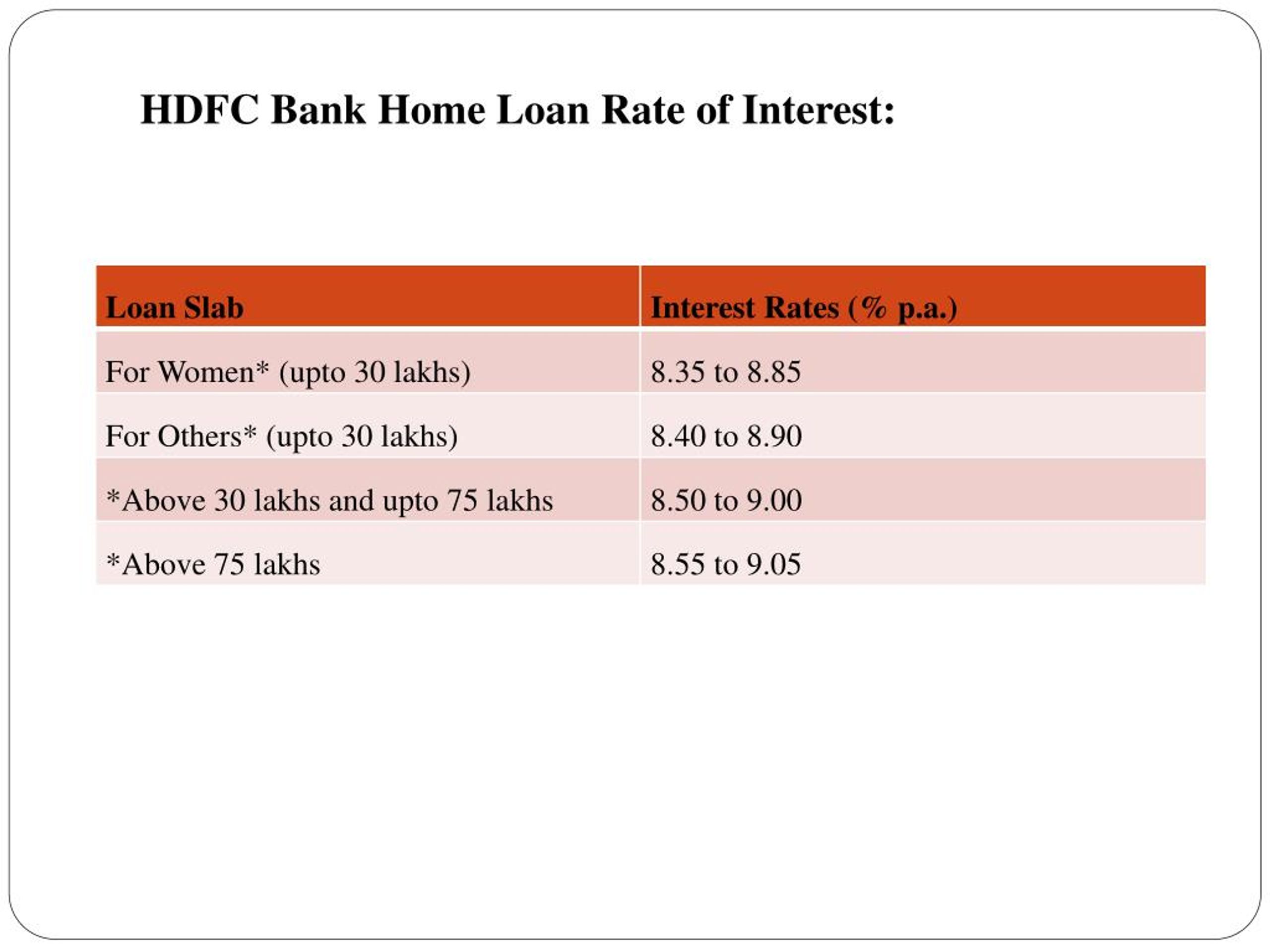

Seeking funds to buy a plot, a new or an under-construction house in a rural area? You can get the same from HDFC Limited as part of its rural housing finance scheme. The rates for the same are shown below across different loan amounts. HDFC also offers a facility of a pre-approved home loan even before you have identified your dream home. A pre-approved home loan is an in-principal approval for a loan given on the basis of your income, creditworthiness and financial position.

What is the maximum purchase price I can afford?

Private sector lender HDFC Bank has hiked its marginal cost of funds-based lending rate . The new loan interest rates are effective from December 7, 2022. When a home loan is taken at a floating rate, you are borrowing it at the current market rate with the condition that you’ll repay the loan as per the current market rate. Today most home loans are linked to the repo rate-based lending rate, which means whenever repo rates rise, the floating rate home loans will become costly, resulting in a sequential rise in the EMIs. Private sector HDFC Bank has hiked its marginal cost of funds-based lending rate . The one-year MCLR, which acts as benchmark for many consumer loans, has increased by 50 basis points to 8.60 percent, HDFC Bank website said.

“There is already a growing desire of owning a home as consumers look at it as a necessity in this unprecedented time of the COVID-19 pandemic. This is the second hike by HDFC in lending rates in August— on August 1, 2022, the mortgage lender had hiked the rate by 25 basis points. Since May this year, this is the sixth increase in home loan rates by HDFC. The private lender joins the league of banks that have announced hikes in home loan interest rates recently. The applicant’s credit score plays a significant role in the home loan interest rate that he can get with the bank.

Home Loan Interest Rate, EMI Calculator for Rs 30 Lakh

Incidental charges & expenses are levied to cover the costs, charges, expenses and other monies that may have been expended in connection with recovery of dues from a defaulting customer. A copy of the policy can be obtained by customers from the concerned branch on request. These articles, the information therein and their other contents are for information purposes only. All views and/or recommendations are those of the concerned author personally and made purely for information purposes. Nothing contained in the articles should be construed as business, legal, tax, accounting, investment or other advice or as an advertisement or promotion of any project or developer or locality. Segment, amid banks offering generous cuts in their interest rates.

Loan amount is 37 lakhs with the interest rate of 8.75% floating. It is a pathetic service according to the change interest rate. If the rate is reduced they will not change it, I need to contact customer support and mail them to get back my money. It is increased will be done automatically without any notification regarding the EMI amount. The above interest rates / EMI are applicable for loans under the Adjustable Rate Home Loan Scheme of HDFC Home Loans.

In last summit of 2022, EU agrees to slap more sanctions on Russia, additional funds for Ukraine

Once the details have been fed, you can click on the ‘Calculate’ button to get a detailed breakup of your loan including the amount payable towards interest. What’s the difference between a Home Improvement Loan and Home Extension Loan? If you want to add extra spaces or rooms to your existing houses, the cost can be taken care of by availing the Home Extension Loan.

Loan amortization is the process of reducing the debt with regular payments over the loan period. A home loan amortization schedule is a table giving the details of the repayment amount, principal and interest component. It includes repayment of the principal amount and payment of the interest on the outstanding amount of your home loan. “The government should seriously consider revising the price bandwidths for homes to qualify as affordable housing to align with the market dynamics of different cities. Anuj Puri, Chairman of Anarock Group, says there are many expectations that overlap with demands in the previous years but they have, so far, not been or insufficiently met.

After SBI, Now HDFC Bank Hikes Interest Rate On Fixed Deposits. Check Revised Rates Here

As per the regulatory filing, the 1-year MCLR is hiked by 20 basis points to 8.25 percent from the current 8.05 percent. The 2-year MCLR will rise by 25 basis points to 8.35 percent from the present 8.10 percent. The 3-year MCLR rate will increase by 30 basis points to 8.40 percent from the current 8.10 percent. According to the HDFC Bank website, effective from December 7, 2022, the overnight MCLR is now 8.30% from earlier 8.20%, an increase of 10 basis points . The MCLR for one month is 8.30% up from 8.25%, an increase of 5 bps. The three-month and six-month MCLRs will be 8.35 percent and 8.45%, respectively.

The bank has also revised its repo-linked lending rate to 9.10 percent. I have taken the home loan from HDFC Limited when i purchased the house. There is no requirement to call the customer care because i used to resolve the issue in app. But the interest rates are very high since my builder has a tied up with HDFC and i have no other option so that i went with them. They do have a part payment and pre-closure facility without having any additional charges.

On the other hand, you can take a Home Improvement Loan if you are planning to renovate your house. Loans for salaried individuals with a minimum monthly income of Rs.10,000 and for self-employed individuals with an income of Rs.2 lakh p.a. It’s always advised to calculate your EMI beforehand so that you can manage your finances properly after you take a loan. The users should exercise due caution and/or seek independent advice before they make any decision or take any action on the basis of such information or other contents.

However, the HDFC home loan interest rate varies from one home loan scheme to another. For your convenience, HDFC offers various modes for repayment of the home loan. You may either issue post-dated cheques or standing instructions to your banker to pay the installments through ECS from your Non-Resident Account / Non-Resident Account in India.

Get a balance transfer – Opt for balance transfer only if you feel that your current lender is charging a higher interest rate than other lenders. Most banks offer home loan balance transfer facilities, through which you can shift your loan account to the concerned bank offering lower rate of interest. When do I have to start paying off the EMIs for my HDFC Home Loans?

No comments:

Post a Comment